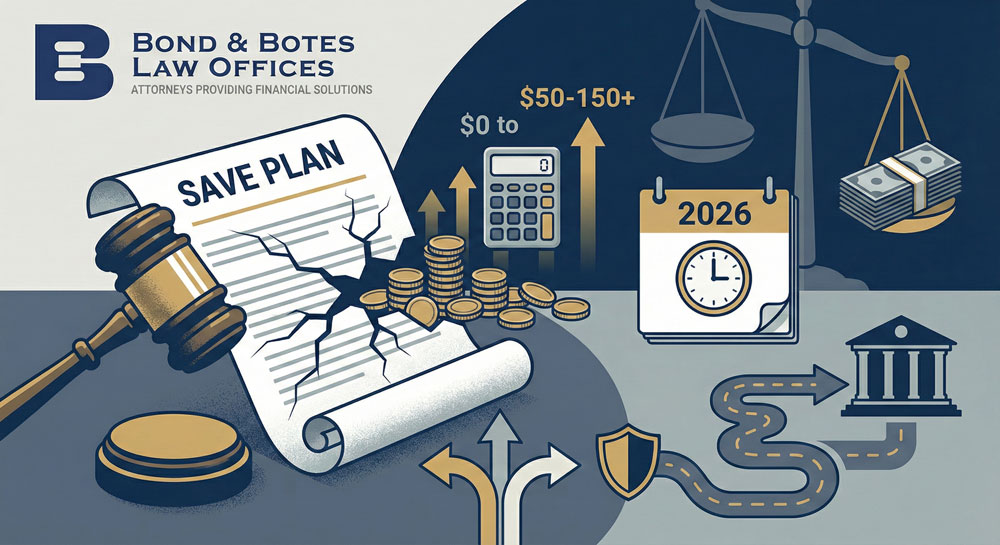

Student Loan Changes in 2026: What the End of the SAVE Plan Means

Submitted by the Bond & Botes Law Offices - Wednesday, January 21, 2026

A major federal student loan change is underway and will affect millions of borrowers nationwide — including a significant number of borrowers in Alabama and Mississippi.

Attorney Spotlight: Jonathan Hull

Submitted by the Bond & Botes Law Offices - Wednesday, January 21, 2026

This month, we’re proud to spotlight Jonathan Hull, an Associate Attorney in our Opelika office who exemplifies dedication, reliability, and teamwork.

A Financial Reset for the New Year: Finding Clarity After the Holidays

Submitted by the Bond & Botes Law Offices - Wednesday, January 21, 2026

As we enter 2026, many families across Alabama and Mississippi are feeling financial pressure from multiple directions at once. Post-holiday expenses, rising everyday costs, and student loan obligations coming due have left many households wondering how everything will fit into their budget.

A New Year’s Resolution Worth Considering: Getting Clear About Your Debt Options

Submitted by the Bond & Botes Law Offices - Tuesday, January 6, 2026

The beginning of a new year causes a lot of people to stop and take stock. We think about health, family, work, and—often quietly—money. For many Alabama and Mississippi families, financial stress is not new. It has simply followed them from one year into the next.

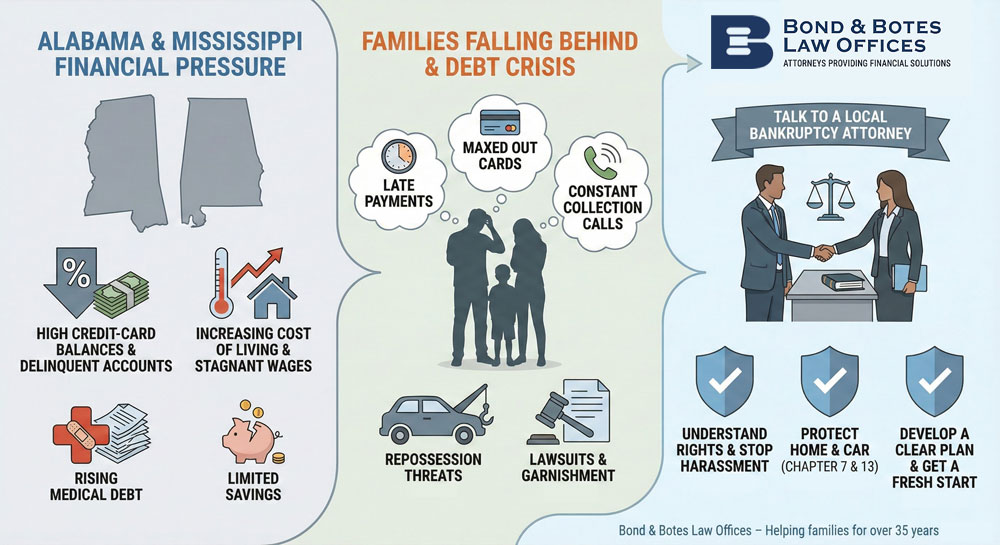

Rising Living Costs in Alabama & Mississippi: Why More Working Families Are Falling Behind

Submitted by the Bond & Botes Law Offices - Wednesday, December 17, 2025

Across Alabama and Mississippi, we are seeing a troubling trend: more families are working full-time, doing what they are supposed to do, and still falling behind financially.

Your 2026 Financial Reset: A Fresh Start Checklist

Submitted by the Bond & Botes Law Offices - Monday, December 8, 2025

As the year wraps up, many families across Alabama and Mississippi are feeling stretched—emotionally, mentally, and financially. Between higher grocery costs, holiday obligations, inflation, and the return of student loan payments, it’s easy for even the most responsible households to feel like they’re falling behind.

Attorney Spotlight: Attorney Tanya McCalpin

Submitted by the Bond & Botes Law Offices - Friday, December 5, 2025

Every Bond & Botes office has someone who keeps the wheels turning, the clients supported, and the entire team grounded. In Florence, that person is Tanya — affectionately known as “5-Star Tanya.”

Alabama & Mississippi Rank Among the Most Financially Distressed States — What That Means for Local Families Facing Debt

Submitted by the Bond & Botes Law Offices - Friday, December 5, 2025

A recent WalletHub study ranked both Alabama and Mississippi among the most financially distressed states in the country. For many families here, that headline hits close to home. Prices are up, interest rates are up, and a lot of people are trying to make ends meet while juggling credit-card bills, car payments, and medical debt.

A recent WalletHub study ranked both Alabama and Mississippi among the most financially distressed states in the country. For many families here, that headline hits close to home. Prices are up, interest rates are up, and a lot of people are trying to make ends meet while juggling credit-card bills, car payments, and medical debt.A Thanksgiving Message From All of Us at the Bond & Botes Law Offices

Submitted by the Bond & Botes Law Offices - Monday, November 24, 2025

As Thanksgiving draws near, all of us at the Bond & Botes Law Offices find ourselves reflecting on the many people who make our work meaningful. This season naturally brings a sense of gratitude, and we want to pause and acknowledge the individuals who support, trust, and inspire us every day.

3 Smart Money Moves Before the Holidays Hit

Submitted by the Bond & Botes Law Offices - Wednesday, November 19, 2025

At Bond & Botes Law Offices, we understand how financial stress can creep into what should be a joyful season. That’s why our team put together a short video—“3 Smart Money Moves Before the Holidays Hit”—to help you stay grounded, grateful, and financially confident this year.

1-877-581-3396

1-877-581-3396