Submitted by the Bond & Botes Law Offices - Friday, December 5, 2025

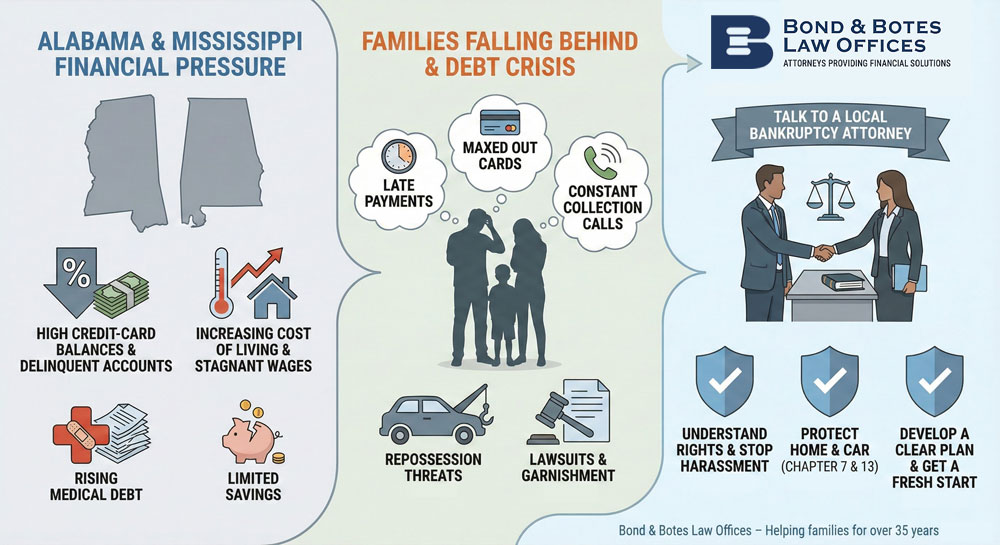

A recent WalletHub study ranked both Alabama and Mississippi among the most financially distressed states in the country. For many families here, that headline hits close to home. Prices are up, interest rates are up, and a lot of people are trying to make ends meet while juggling credit-card bills, car payments, and medical debt.

At the Bond & Botes Law Offices, we meet with people across Alabama and Mississippi every day who feel overwhelmed, stressed, and unsure what to do next. This study simply puts numbers behind what so many families are already experiencing.

Why Alabama and Mississippi Rank So High in Financial Stress

WalletHub looked at things most people dealing with money problems already worry about:

-

High credit-card balances

-

Delinquent or past-due accounts

-

Limited savings or emergency funds

-

Rising medical debt

-

Stagnant wages

-

Increasing cost of living

When those factors stack up, it’s easy to see why so many households in our region are struggling. None of this means you’re irresponsible or alone. It means the financial pressure in our area is real — and growing.

Why So Many Families Are Falling Behind

1. Cost of living is rising faster than income

Even small increases in groceries, gas, insurance, and utilities can push a family into credit-card debt. When wages don’t keep up, people end up relying on credit to fill the gap.

2. Credit-card and auto-loan interest rates are the highest in years

This trap feels familiar: you make payments every month, but the balance barely moves. Many people call us because they’re tired of feeling stuck.

3. Medical debt hits Alabama and Mississippi harder than most states

A single unexpected medical issue can send a budget spiraling. Our region consistently ranks among the highest in medical debt in collections.

4. Little or no savings leaves families vulnerable

Without a financial cushion, it only takes one setback — a car repair, illness, job change, or divorce — to start the downhill slide.

When Normal Financial Stress Turns Into a Debt Crisis

Most people try to handle things on their own for far too long. The early signs usually look like this:

-

Payments run late

-

A credit card maxes out

-

A lender threatens repossession

-

A lawsuit or garnishment notice arrives

-

Collection calls become constant

By the time someone reaches out to us, they’re worn out and embarrassed — and they shouldn’t be. Money problems happen to good, hardworking people every day.

What This Means for People in Alabama and Mississippi Who Are Struggling With Debt

The most important thing to know is this: you have options.

A lot of people think bankruptcy means losing everything. That’s not the case. In fact, most Chapter 7 filers keep all or nearly all of their property because of the protections allowed under Alabama and Mississippi exemption laws. Chapter 13 can also help people save their home or car and get into a manageable payment plan.

Bankruptcy may be the right option if you’re dealing with:

-

Credit-card debt you can’t get ahead of

-

Threats of repossession or foreclosure

-

Medical bills you’ll never be able to pay

-

Wage garnishment

-

Personal loans, payday loans, or title loans

-

Constant collection calls

Even if bankruptcy isn’t the answer, talking with someone who handles these issues every day can give you peace of mind and a clear plan.

Why Talking to a Local Bankruptcy Attorney Early Helps

Waiting usually makes things harder. A quick conversation with a knowledgeable bankruptcy lawyer can help you:

-

Understand your rights

-

Stop creditor harassment

-

Protect your car or home

-

Learn whether Chapter 7 or Chapter 13 could help

-

Avoid costly financial mistakes

-

Get a realistic idea of what your future can look like

Our job isn’t to judge — it’s to help people get back on their feet.

We’ve Helped Thousands of Families in Alabama and Mississippi Get a Fresh Start

Phone: 877-581-3396

Email: Click Here to email us through our website

Website: https://www.bondnbotes.com/

This post is intended for general information only and does not constitute legal advice. To discuss your specific situation, we encourage you to schedule a confidential consultation with an attorney.

1-877-581-3396

1-877-581-3396