Submitted by the Bond & Botes Law Offices - Wednesday, January 21, 2026

Understanding the Federal Shift

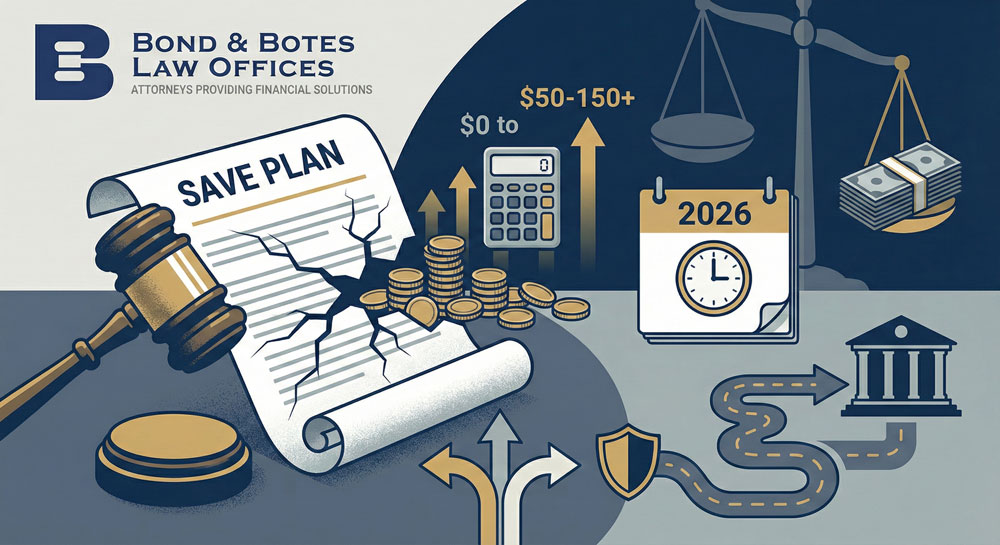

A major federal student loan change is underway and will affect millions of borrowers nationwide — including a significant number of borrowers in Alabama and Mississippi.

Here are the key, factual developments:

- The SAVE repayment plan, created under President Biden, was blocked in 2024 following lawsuits brought by multiple states.

- In late 2025, the Trump administration reached a settlement with Missouri that officially ended the SAVE program.

- Because SAVE is a federal repayment plan, its termination applies nationwide — not just to Missouri or the states involved in the lawsuits.

As a result, the U.S. Department of Education must:

- Stop enrolling new borrowers into SAVE

- Deny pending SAVE applications

- Transition current SAVE participants into alternative repayment plans

What This Means for Borrowers Nationwide

Many borrowers who previously qualified for $0 monthly payments under SAVE may now see higher required payments. In addition:

- Accelerated forgiveness pathways are no longer available

- Borrowers placed in administrative forbearance will resume repayment

- Payment obligations are returning just as other household bills are increasing

These changes are occurring at the same time many families are carrying post-holiday credit card balances and higher interest expenses.

How Student Loan Changes Impact Alabama & Mississippi Borrowers

The termination of SAVE disproportionately affects borrowers in Alabama and Mississippi due to regional economic factors that make even modest payment increases harder to absorb.

1. Higher SAVE Enrollment Rates in the Deep South

Lower median incomes and higher default rates led many borrowers in Alabama and Mississippi to adopt SAVE at higher rates than borrowers in wealthier states. As SAVE ends, more families in the region are losing access to the plan.

2. Many Borrowers Paid $0 Under SAVE

SAVE’s income-based formula allowed a significant number of borrowers in Alabama and Mississippi to qualify for $0 monthly payments. Those same borrowers may now owe $50 to $150 per month or more, creating sudden budget strain.

3. Greater Financial Vulnerability

Higher poverty rates, increased medical debt, and lower household savings mean even small payment increases can cause significant stress. Historically, this is why the Deep South sees higher bankruptcy filings per capita.

4. Restarting After Years Without Payments

Many borrowers have not made student loan payments in years due to injunctions and administrative forbearances. When payments restart with capitalized interest and higher balances, the shock can be immediate.

5. Bankruptcy Strategy Will Shift in 2026

Because student loans are rarely dischargeable, borrowers increasingly use bankruptcy strategically to:

- Eliminate credit card debt

- Stop wage garnishments

- Address medical bills

- Create room in the budget for required federal loan payments

This shift is expected to lead to an increase in Chapter 13 bankruptcy filings, which provide structured repayment protections.

6. Payment Confusion Is Creating Panic

Many borrowers will not receive their new payment amounts until shortly before payments are due. This lack of clarity often results in panic and a surge in calls to bankruptcy law offices.

7. Parent PLUS Borrowers Are Especially Impacted

Alabama and Mississippi have higher-than-average Parent PLUS loan usage. These loans do not qualify for SAVE-style relief, leaving older borrowers — often nearing retirement — with high, inflexible payments.

Bottom Line:

Ending SAVE impacts lower-income states more severely and arrives at the worst possible time — just as holiday balances come due.

This post is intended for general information only and does not constitute legal advice. To discuss your specific situation, we encourage you to schedule a confidential consultation with an attorney.

1-877-581-3396

1-877-581-3396